About Estate Planning Attorney

About Estate Planning Attorney

Blog Article

The Basic Principles Of Estate Planning Attorney

Table of ContentsEstate Planning Attorney Fundamentals ExplainedHow Estate Planning Attorney can Save You Time, Stress, and Money.How Estate Planning Attorney can Save You Time, Stress, and Money.Not known Details About Estate Planning Attorney More About Estate Planning Attorney

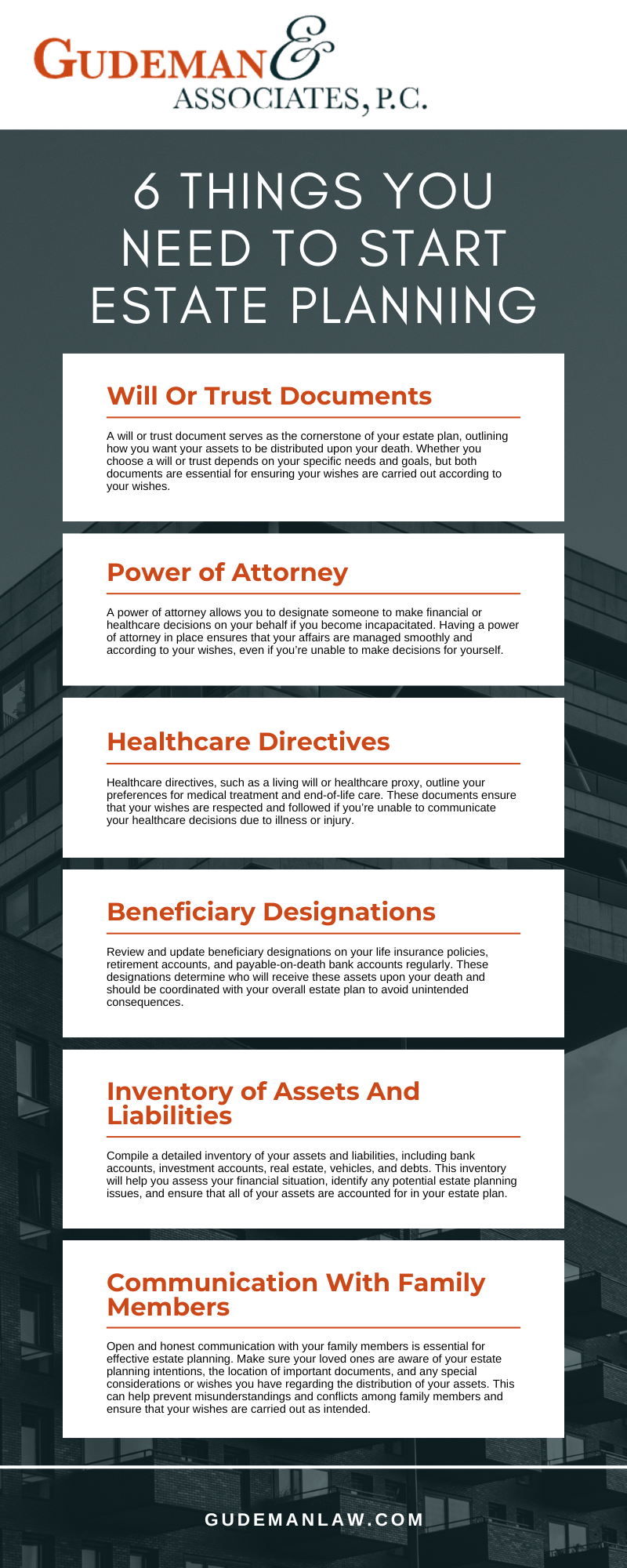

Facing end-of-life choices and safeguarding family members riches is a difficult experience for all. In these difficult times, estate planning lawyers help people prepare for the distribution of their estate and establish a will, trust, and power of lawyer. Estate Planning Attorney. These attorneys, additionally referred to as estate regulation lawyers or probate attorneys are accredited, skilled specialists with a comprehensive understanding of the government and state regulations that put on exactly how estates are inventoried, valued, distributed, and tired after death

The intent of estate planning is to appropriately plan for the future while you're sound and capable. A correctly ready estate plan lays out your last dreams exactly as you desire them, in the most tax-advantageous fashion, to prevent any inquiries, misconceptions, misconceptions, or disputes after death. Estate preparation is an expertise in the legal profession.

All About Estate Planning Attorney

These attorneys have a comprehensive understanding of the state and federal regulations associated with wills and trust funds and the probate process. The tasks and obligations of the estate lawyer may consist of counseling customers and drafting lawful records for living wills, living trusts, estate strategies, and estate tax obligations. If needed, an estate preparation lawyer might take part in litigation in probate court in behalf of their customers.

, the work of lawyers is expected to grow 9% in between 2020 and 2030. Regarding 46,000 openings for attorneys are predicted each year, on standard, over the decade. The course to coming to be an estate preparation lawyer is comparable to other technique areas.

Preferably, take into consideration possibilities to obtain real-world job experience with mentorships or internships associated with estate preparation. Doing so will certainly give you the skills and experience to make admittance right into regulation college and connect with others. The Regulation School Admissions Examination, or LSAT, is an essential component of putting on regulation institution.

Normally, the LSAT is offered 4 times annually. It is very important to get ready for the LSAT. The majority of prospective trainees start studying for the LSAT a year beforehand, usually with a study hall or tutor. The majority of regulation pupils obtain regulation institution throughout the loss semester of the final year of their undergraduate research studies.

Some Known Incorrect Statements About Estate Planning Attorney

Usually, the yearly wage for an estate lawyer in the united state is $97,498. Estate Planning Attorney. On the high end, an estate preparation attorney's wage may be $153,000, according to ZipRecruiter. The quotes from Glassdoor are similar. Estate preparing attorneys can operate at large or mid-sized law practice or branch out by themselves with a solo technique.

This code connects to the restrictions and regulations imposed on wills, depends on, and other legal records appropriate to estate planning. The Uniform Probate Code can vary by state, but these legislations control different elements of estate preparation and probates, such as the creation of the count on or the lawful validity of wills.

Are you unclear concerning what career to seek? It is a difficult concern, and there is no easy solution. However, you can make some considerations to assist decide less complicated. Sit down and note the points you are good at. What are your toughness? What do here are the findings you delight in doing? When you have a checklist, you can limit your choices.

It includes choosing exactly how your properties will be distributed and that will handle your experiences if you can no much longer do so on your own. Estate planning is a needed part of financial preparation and need to be made with the help of a certified specialist. There are a number of aspects to take into consideration when estate planning, her latest blog including your age, health, monetary scenario, and family scenario.

Indicators on Estate Planning Attorney You Should Know

If you are young and have few ownerships, you may not require to do much estate planning. If you are older and have extra valuables, you have to consider distributing your assets among your beneficiaries. Health: It is a necessary variable to take into consideration when estate preparation. If you remain in health, you may not require to do much estate planning.

If you are wed, you should consider exactly how your assets will certainly be distributed between your spouse and your heirs. It intends to make sure that your properties are dispersed the way you want them to be after you die. It includes considering any taxes that may need to be paid on your estate.

See This Report on Estate Planning Attorney

The attorney likewise helps the people Read More Here and households develop a will. A will certainly is a legal file stating just how individuals and families want their properties to be distributed after death. The lawyer additionally assists the individuals and family members with their trusts. A trust is a legal document permitting individuals and households to move their assets to their recipients without probate.

Report this page